Callan DC Index Off to a Strong Start

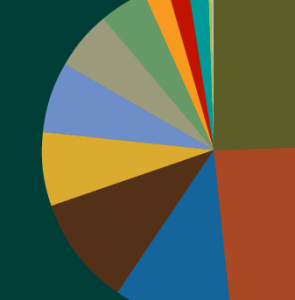

We recently published the latest data for the Callan DC Index™ , which tracks performance, asset allocation, and cash flows of over 90 large defined contribution plans representing approximately $150 billion in assets. Highlights for the quarter (data as of 6/30/2017): The Callan DC Index™ returned a healthy 3.06% during the second quarter, reflecting strong equity market […]

The Evolution of Target Date Funds

Callan examined hypothetical participant outcomes for various time periods.

Are We Ready to Fund Retirement from DC Plans?

DC plans have been focused on the accumulation of assets for retirement, and the DC industry has spent considerable effort to improve investment offerings, control costs, encourage participation, and streamline the technology of the participant’s interaction with the plan. But what about the distribution of accumulated savings to retirees? Over the last decade, defined contribution […]

8 Tips for DC Plan Sponsors to Avoid Fiduciary Traps

Defined contribution (DC) plan sponsors often worry about landing in hot water for doing the wrong thing. However, many fiduciary issues crop up because plan sponsors have failed to take action. Here, we list eight potential fiduciary traps and suggest ways to avoid them. Trap 1: The plan’s recordkeeper calls the shots. Even amid ongoing […]

Managing DC Plan Vendors

View PDF For defined contribution (DC) plans, managing recordkeepers can be daunting. In the latest edition of the DC Observer, Callan’s Jamie McAllister and Jana Steele outline ways to make this vital oversight process easier. One of the best ways to help monitor recordkeepers is by conducting periodic searches, which give plan sponsors the chance […]

DC Index, 1st Quarter 2017

We recently published our latest data for the Callan DC Index™ , which tracks performance, asset allocation, and cash flows of over 90 large defined contribution plans representing approximately $150 billion in assets. Highlights from the quarter (data as of 3/31/17) include: DC plans benefited from strong market performance during the quarter. The Callan DC […]

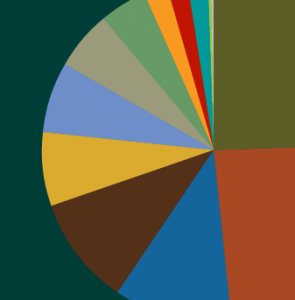

About Our Revamped Target Date Index

With target date funds (TDFs) now accounting for nearly 30% of the average defined contribution plan’s assets, understanding their performance, fees, and asset allocations is more important than ever. That’s why Callan has improved our quarterly target date fund coverage by making the Callan Target Date Index™ website interactive. The new features include these improvements: […]

No Homefield Advantage for Fund Sponsors

View PDF A post-election rally, higher interest rates, and political uncertainty in Europe and Asia left global markets unfazed as stocks and bonds rallied. Both U.S. and non-U.S. stocks delivered stellar returns in the first three months of 2017. That put some juice into the performance of institutional funds tracked by Callan, which did far […]

No-Nonsense Guide to White Label Funds

“White label” funds are investment structures built using a mix of underlying funds to provide a simple but rich multi-manager exposure to an asset class. Their intuitive labeling (i.e., “Company XYZ Small Cap Fund”) is designed to help participants easily understand the role of a specific fund in a portfolio. White label structures also help […]

DC Index, 4th Quarter 2016

The Callan DC Index™ ended 2016 with a return of 7.99%, its best year since 2013. The Index reflects the performance, asset allocation, and cash flows of more than 90 large defined contribution (DC) plans representing approximately $150 billion in assets. Despite the turbulent economic and political environment of last year, including the Brexit vote in […]