Assessing High Yield Bonds in the Current Environment

High yield allocations late in the cycle may seem like a bad idea, but investors’ need for yield in the face of falling rates for government bonds is strong. The credit market is still appealing. The higher coupon-clipping aspect of spread has led to superior returns over time. High yield fundamentals broadly speaking remain stable, […]

Mostly Strong Gains Amid Geopolitical Uncertainty

Equity Markets The S&P 500 gained 1.7% in the third quarter, and 20.6% for the year to date. However, returns were mixed across sectors. Utilities (+9.3%) and Real Estate (+7.7%) both benefited from lower interest rates. Gains for both sectors are approaching 30% on a year-to-date basis. Energy, hurt by falling oil prices, lost 6.3% […]

What Fixed Income Managers Are Thinking Now

The past year has provided no shortage of major changes in the market for fixed income managers to assess. As one example, a year ago many expected multiple rate hikes by the Federal Reserve. Now, almost all forecast additional rate cuts before the end of the year. To better understand the current market climate, we conduct regular […]

Stocks and Bonds Lifted by Rate Cut Optimism

In the wake of the Fed’s announcement of a new policy objective—to “sustain the expansion”—U.S. Treasury and stock markets approached record highs in the second quarter, and the 10-year U.S. Treasury yield hit a multi-year low. Equity Markets The S&P 500 Index rose 4.3%, bringing its year-to-date return to 18.5%. Financials (+8.0%) were the best […]

How We Developed Our 2019-2028 Capital Market Projections

View PDF Callan develops long-term capital market projections at the start of each year, detailing our expectations for return, volatility, and correlation for broad asset classes. These projections represent our best thinking regarding a longer-term outlook and are critical for strategic planning as our investor clients set investment expectations over five-year, ten-year, and longer time […]

The Rise of BBBs: To Worry or Not to Worry?

Over the last year or so, the growth of BBB-rated debt as a percentage of the overall investment-grade corporate bond market has sparked significant debate among investors. The key issue: the implications to the fixed income market should bonds at the lowest rung of the investment-grade ladder be downgraded. Background: There are two distinct sections of […]

The Outlook From Fixed Income Managers

View the Outlook Callan conducts a quarterly survey of select fixed income managers to gauge their sentiments about the current market environment and solicit their near-term outlook (6-9 months) on key issues such as Federal Reserve rate hikes, inflation, and other factors that affect bond portfolios. In our most recent survey, for the first quarter […]

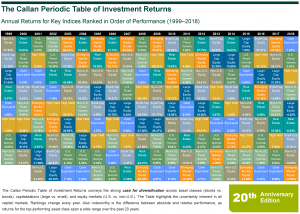

The Periodic Table Turns 20

Classic Table No one is more surprised than I am at the longevity and usefulness of the Callan Periodic Table of Investment Returns. I put the table together in 1999 as a lark, in an effort to convince our clients’ investment committees that U.S. large cap growth stocks were not always going to be the […]

Some Havens in Bonds, but Not in Real Assets

Global fixed income benefited from a tumultuous equity market and concerns over slowing growth in the fourth quarter, but liquid real asset investors found few places to hide. Fixed Income In the U.S., the Bloomberg Barclays US Aggregate Bond Index rose 1.6% for the quarter, with U.S. Treasuries (Bloomberg Barclays US Treasury: +2.6%) leading the […]

Global Macroeconomic Environment: Is the Glass Half Full or Half Empty?

Investors’ appetite for risk, while elevated for much of 2018, evaporated as the year drew to a close and wiped out positive returns for the year across broad asset classes (T-bills being a notable exception). Concerns over tighter monetary policy and the global withdrawal of stimulus measures, unresolved trade disputes, falling oil prices, slower global […]