Perspective on Turkey

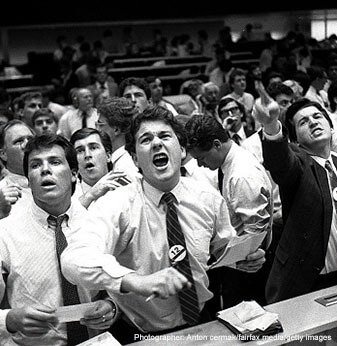

Troubles in Turkey’s capital markets—a depreciating lira, plunging stock market, skyrocketing bond yields—are raising concerns about contagion. The country’s problems are unique to its circumstances and largely a result of internal policy, but investor concerns are starting to spread across all emerging markets, whether justified or not. EM investing has always come with heightened volatility, […]

Yield Curve Shenanigans?

The U.S. Treasury yield curve has been on a “flattening” trend since the end of 2013. At the end of 2013, the difference between the 2-year and 10-year U.S. Treasury note yield was 260 basis points; today it is roughly 30 bps. The last time the spread was this low was in August 2007, just […]

Is This It for the Current Economic Expansion?

Real GDP growth in the U.S. hit 4.1% in the second quarter of 2018, the strongest quarterly gain since 2014. Many indicators corroborate the story of a thriving American economy: low unemployment, robust consumer spending, elevated business and consumer confidence, and growth in non-residential investment. However, a big contributor to growth was a surge in […]

Follow the Money: Asset Flow Data Support Industry Trends

Twice a year, Callan takes a deep dive into asset flow data to extrapolate trends and identify the most successful investment managers in each asset class. What we found in our most recent analysis, for year-end 2017, is consistent with many of the broad challenges the institutional asset management industry is facing. However, this analysis […]

How Stocks, Bonds, and Real Assets Did in the 2nd Quarter

U.S. stocks did well in the 2nd quarter and outpaced non-U.S. equities. Rates rose in the U.S. and the yield curve flattened. Currencies drove returns for non-U.S. fixed income. Geopolitics played a big role in commodity returns

Summer Doldrums for the Economy?

Summer months are typically a quiet time for the markets. Recent events, however, may disrupt this tradition. Threats of escalating trade wars have cast a pall over equities, and numerous geopolitical uncertainties continue to push investors toward a more cautious stance. A desynchronization in global growth as well as a divergence in central banks’ monetary […]

Under the Hood of the MSCI EM Index

Remember the BRIC countries? The acronym was coined in 2001 by Goldman Sachs economist Jim O’Neill for the economies of Brazil, Russia, India, and China to convey that their relative economic growth would continue to exceed that of the so-called Group of 7 (Britain, Canada, France, Germany, Italy, Japan, and the United States) and thus […]

Slow Burn

View PDF After a weak first quarter, the U.S. economy closed out 2017 with decent momentum, as GDP grew at a robust 3% annualized rate for the remaining three quarters. The first quarter of 2018 will likely be remembered for its sudden, brief correction and the return of volatility. True to form, however, the U.S. […]

Mixed Results for Global Fixed Income Markets 1Q18

The Bloomberg Barclays US Aggregate Bond Index fell 1.5%, with corporate and securitized sectors underperforming Treasuries. The Bloomberg Barclays Global Aggregate Index (hedged) fell 0.1% (versus a gain of 1.4% for the unhedged version). Local currency emerging market debt was a top-performing asset class in the first quarter.

Global Equities: Volatility Returns and Markets Sag

Volatility returned in the first quarter and U.S. equities faltered over concerns about a more aggressive global trade policy and uncertainty over the pace of interest rate hikes. .