Change of Mind on Global Economic Growth

Markets Update Confidence in the strength of the global economy evaporated suddenly in October 2018, leading to sharp declines in equity and commodity prices, widening interest rate spreads, and an appreciation of the U.S. dollar. Little in the underlying fundamentals of the U.S. economy had changed: GDP enjoyed solid gains of 4.2% and 3.4% in […]

Excited About U.S. Equity Returns? Don’t Forget Pets.com

Over the past several years the performance of the U.S. equity market has widely outpaced the rest of the world. Part of the reason for that outperformance has been the superior growth trajectory in the U.S. following the Global Financial Crisis (GFC), and part stemmed from the expansion of multiples in U.S. equities. Another less […]

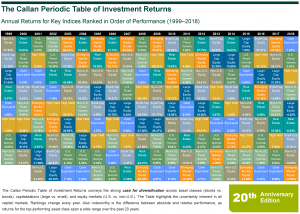

The Periodic Table Turns 20

Classic Table No one is more surprised than I am at the longevity and usefulness of the Callan Periodic Table of Investment Returns. I put the table together in 1999 as a lark, in an effort to convince our clients’ investment committees that U.S. large cap growth stocks were not always going to be the […]

Some Havens in Bonds, but Not in Real Assets

Global fixed income benefited from a tumultuous equity market and concerns over slowing growth in the fourth quarter, but liquid real asset investors found few places to hide. Fixed Income In the U.S., the Bloomberg Barclays US Aggregate Bond Index rose 1.6% for the quarter, with U.S. Treasuries (Bloomberg Barclays US Treasury: +2.6%) leading the […]

Rocky Ride for Equity Investors at the End of 2018

The fourth quarter saw volatility return with a vengeance, especially in December. While economic worries played a role, a government shutdown, continued trade rhetoric, and broad-based risk aversion also fueled the sell-off

Global Macroeconomic Environment: Is the Glass Half Full or Half Empty?

Investors’ appetite for risk, while elevated for much of 2018, evaporated as the year drew to a close and wiped out positive returns for the year across broad asset classes (T-bills being a notable exception). Concerns over tighter monetary policy and the global withdrawal of stimulus measures, unresolved trade disputes, falling oil prices, slower global […]

Equity Risk Looms Large for Fund Sponsors

The median fund sponsor in Callan’s database gained 2.7% in the third quarter. Taft-Hartley plans (+3.0%) were the best-performing sponsor by type, as they were the previous quarter; corporate plans (+2.3%) showed the lowest increase.

Everything Is Great! Right?

View PDF September 20 marked the capstone of a summer run-up in the U.S. equity market. We saw a true market correction in February (S&P 500 Index down 10.1%) and a drawdown of more than 7% in March, but the memory of those experiences was obliterated by a smooth, steady climb, with the S&P 500 […]

A Look at the Markets in 3Q18

U.S. stocks broadly rose, outpacing non-U.S. equities. Fixed income returns were muted, while real assets saw a wide range of results.

What a Difference a Decade Makes!

Happy 10-year anniversary to the Global Financial Crisis! Just a decade ago, some of the world’s largest and most revered financial institutions, along with the modern financial system itself, were left staring into the abyss. And yet, as grave as things appeared in September 2008 and during the months that followed, the global economy just 10 years later finds itself in the midst of one of the longest economic expansions in the modern era.