Slow Burn

View PDF After a weak first quarter, the U.S. economy closed out 2017 with decent momentum, as GDP grew at a robust 3% annualized rate for the remaining three quarters. The first quarter of 2018 will likely be remembered for its sudden, brief correction and the return of volatility. True to form, however, the U.S. […]

Mixed Results for Global Fixed Income Markets 1Q18

The Bloomberg Barclays US Aggregate Bond Index fell 1.5%, with corporate and securitized sectors underperforming Treasuries. The Bloomberg Barclays Global Aggregate Index (hedged) fell 0.1% (versus a gain of 1.4% for the unhedged version). Local currency emerging market debt was a top-performing asset class in the first quarter.

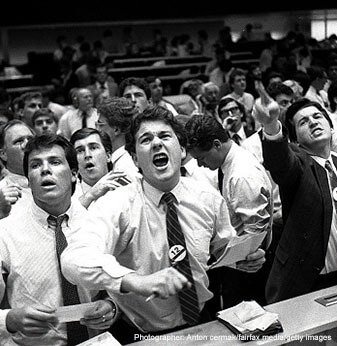

Global Equities: Volatility Returns and Markets Sag

Volatility returned in the first quarter and U.S. equities faltered over concerns about a more aggressive global trade policy and uncertainty over the pace of interest rate hikes. .

Managing Risk While Hunting for Returns

Low interest rates and low return expectations continued to drive strategic allocation discussions for fund sponsors. Many felt compelled to take on market risk to reach return targets. Sponsors are now examining if there is anything they can do to tamp down the risk within their large growth allocation short of actually reducing it. For […]

Why So Sad?

The disconnect sharpened in the third quarter between the state of the underlying economy (pretty good) and sentiment (not so good)

Healthy Risk Appetite Drove Global Fixed Income Yields

Global fixed income markets generally performed well in the third quarter. Moderate growth and inflation kept long-term rates low and range bound in the U.S. Rates were also low outside the U.S., but dollar weakness boosted returns. U.S. Bonds: Low Volatility Drove Returns Yields rose modestly, particularly on the short end of the U.S. Treasury […]

Up, Up, Up, and Away for Global Equities

.With volatility extremely low and the global economy humming along, equity markets around the world continued their steady march upward in the third quarter, part of what has been dubbed the “everything rally” as bonds and commodities have also done well

Why Is Inflation So Low?

View PDF We are now eight years into the economic recovery in the U.S., arguably the latter stages of a mature expansion and at a point where inflationary pressures typically begin to build. Yet price and wage inflation remain stubbornly subdued. Headline and particularly core inflation have drifted down over the past several months. Headline […]