Caution: Hard Road Ahead!

GDP growth came roaring back in 3Q20 as expected, notching a 33.1% gain, following the 31.4% decline in 2Q.

The Stock Market Is Not the Economy

The word “unprecedented” to describe the current environment may seem overused, but the speed and depth of the economic disruption was indeed unprecedented.

The Fed Speaks: ‘A Mid-Cycle Adjustment to Policy’

The U.S. economy continued its now-record expansion in the second quarter with a 2.1% gain in GDP, slower than the robust 3.1% in the first quarter but well ahead of expectations. Consumer spending rose 4.3% in the quarter, supported by solid gains in the job market and disposable income growth of 5% in each of […]

What Just Happened?

The full return of the economy depends on the confidence that we are safe to resume jobs, travel, consumption, and daily interaction. Until then, the global economy will be hampered in ways we can only partly anticipate; the unmeasurable risk of the global health crisis will dominate for some time

Assessing the Impact of the Coronavirus for Institutional Investors

The fast-moving coronavirus outbreak and the even faster-moving equity market response to the uncertainty present a significant downside risk to the global economic outlook. Callan does not have anything to say about the epidemic itself, and a lot of great research has already come out from the asset management community. What we can offer is […]

This Time May Really Be Different

View CMR Third quarter U.S. GDP growth surprised on the upside, coming in at 1.9% and extending what is now the longest economic expansion on record to 124 months. While 1.9% sounds modest compared to past cycles, it is positively robust compared to developed economies around the globe. The U.S. economy, and to an extent […]

Resilience in the Face of Uncertainty

View PDF Investor confidence has shifted wildly over the past six months. Anxiety, panic, and gloom pushed equity markets down around the globe through the last three months of 2018, culminating in one of the worst Decembers in decades. The pessimism derailed global interest rate policy. The central banks in the euro zone had yet […]

Risky Business Update: Challenges Remain for Today’s Investors

A Callan analysis found that investors in 2015 needed to take on three times as much risk as they did 20 years before to earn the same expected return. We recently updated our analysis and found that investors in 2019 needed to take on almost six times as much risk as they did 30 years ago

Change of Mind on Global Economic Growth

Markets Update Confidence in the strength of the global economy evaporated suddenly in October 2018, leading to sharp declines in equity and commodity prices, widening interest rate spreads, and an appreciation of the U.S. dollar. Little in the underlying fundamentals of the U.S. economy had changed: GDP enjoyed solid gains of 4.2% and 3.4% in […]

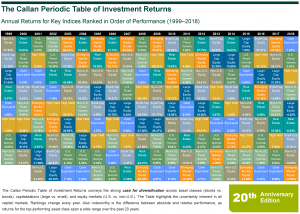

The Periodic Table Turns 20

Classic Table No one is more surprised than I am at the longevity and usefulness of the Callan Periodic Table of Investment Returns. I put the table together in 1999 as a lark, in an effort to convince our clients’ investment committees that U.S. large cap growth stocks were not always going to be the […]