How Your Public DB Plan’s Returns Compare | 2Q23 Update

Callan Public DB Plan Focus Group provides an update on plan returns and analysis of how they compare over time.

How Your Public DB Plan’s Returns Compare | 1Q23 Update

Callan Public DB Plan Focus Group provides an update on plan returns and analysis of how they compare over time.

DOL Calls for Stricter Rules Around ESG Investing in Retirement Plans

The Department of Labor (DOL) in late June proposed guidance for considering environmental, social, and governance (ESG) factors in the investment duties of fiduciaries for both defined benefit and defined contribution plans subject to ERISA. In general, the DOL rule seems intended to create a larger hurdle to incorporating ESG factors into ERISA plan investments. […]

For Corporate Pension Plans, We Have Good News and Bad News

While corporate pension plans have benefited from the rebound in equities since the bumpy fourth quarter of last year, they are facing a challenge on another front: the long duration rates used to discount pension liabilities have been moving in the other direction—a lot. The discount rate used by the short-duration FTSE Pension Liability Index […]

Non-U.S. Bias Rewarded Plans in 2017

Endowments/foundations (+3.8%) performed best last quarter, followed by public plans (+3.7%), Taft-Hartley plans (+3.6%), and corporate plans (+3.5%). For all funds, the return was +3.7%, according to Callan’s database. Plans with assets below $100 million performed best by fund size, up 3.7%, compared to 3.6% for both medium plans ($100 million-$1 billion) and large plans. […]

Completion Managers: An Overview

The pension plan environment is fraught with complexities as increasing regulation and rising costs force plan sponsors to evaluate an array of risks to meet their pension obligations. Many plan sponsors have taken the first steps to de-risk their plans by increasing allocations to fixed income and the duration of those assets to match their […]

No Homefield Advantage for Fund Sponsors

View PDF A post-election rally, higher interest rates, and political uncertainty in Europe and Asia left global markets unfazed as stocks and bonds rallied. Both U.S. and non-U.S. stocks delivered stellar returns in the first three months of 2017. That put some juice into the performance of institutional funds tracked by Callan, which did far […]

ESG Continues to Climb

Download Survey View Charticle For the fourth straight year, Callan’s survey to assess the status of environmental, social, and governance (ESG) factor integration reveals increasing traction among U.S. investors. ESG investing—including responsible and sustainable investment strategies and socially responsible investing—had been adopted more slowly in the U.S. than in other developed markets due to differences […]

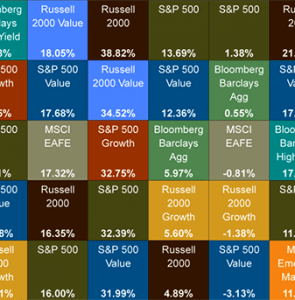

Periodic Table of Investment Returns

One glance at the crazy quilt of colors in the Periodic Table of Investment Returns suggests the challenge investors face in picking an investment class “winner” year-by-year and illustrates the benefit to diversification. Last year offered investors a wild ride, with sentiment overwhelming fundamentals for much of 2016. Bonds rose in value and stocks fell […]

Saving Public Defined Benefit Plans: Talking Points

Download PDF The funded status of public employee defined benefit (DB) retirement plans continues to garner great debate in the industry and press. DB plans are the primary vehicle for ensuring retirement income security for public workers, and Callan believes these plans are viable and necessary in this sector. The following talking points, taken from […]