Top 10 Tips for Investment Committees

View PDF Investment committees face complex challenges overseeing institutional investment funds. They must navigate myriad laws and regulations, select the right managers and strategies, monitor their portfolios, and ensure their funds can deliver the returns needed for their beneficiaries. To help guide these committees, we developed these 10 tips. (For a deeper dive into the […]

DC Index, 4th Quarter 2016

The Callan DC Index™ ended 2016 with a return of 7.99%, its best year since 2013. The Index reflects the performance, asset allocation, and cash flows of more than 90 large defined contribution (DC) plans representing approximately $150 billion in assets. Despite the turbulent economic and political environment of last year, including the Brexit vote in […]

DC Plans and Investment Policy Statements

Download PDF Yogi Berra’s wisdom is particularly apt for investment policy statements (IPS): On the one hand, an investment committee that tries to manage its DC plan without an IPS is apt to lose its way. On the other hand, if—like the Yogi Berra quote—an IPS is unclear or confusing, it can also lead to […]

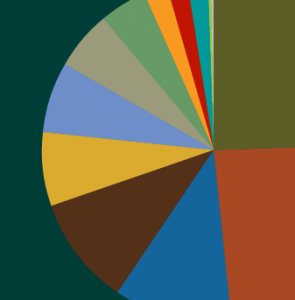

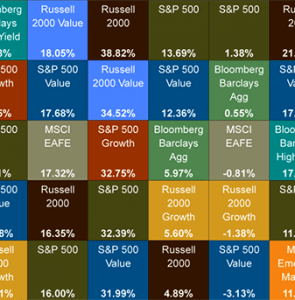

Periodic Table of Investment Returns

One glance at the crazy quilt of colors in the Periodic Table of Investment Returns suggests the challenge investors face in picking an investment class “winner” year-by-year and illustrates the benefit to diversification. Last year offered investors a wild ride, with sentiment overwhelming fundamentals for much of 2016. Bonds rose in value and stocks fell […]

2017 DC Trends Survey

Key Findings Full Survey Our 10th annual Defined Contribution Trends Survey reveals that fees are playing a heightened role in driving plan sponsor decision-making. Reviewing plan fees was cited as a key area of fiduciary focus, both now and for the foreseeable future. Related to this focus on fees are trends including an increase in […]