New Year, New Lows for Real Estate

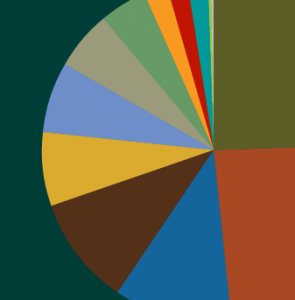

View PDF The NCREIF Property Index advanced 1.55% during the first quarter (1.15% from income and 0.40% from appreciation). This was the lowest return since 2010, eclipsing the fourth quarter’s mark of 1.73%. Appreciation fell for the eighth consecutive quarter and made up less than a third of total return. Industrial (+2.83%) was the best-performing […]

Private Equity on a Roll

View PDF New private equity partnership commitments totaled $80.0 billion in the first quarter, with 310 new partnerships formed, according to preliminary data from Private Equity Analyst. The number of partnerships jumped 75% from 177 in the first quarter of 2016, and the dollar volume rose 51% from $53.1 billion. KKR Americas Fund XII raised […]

The Hedge Fund Edge: Still Sharp or Too Dull?

View PDF Why should investors bother with hedge funds? The original proposition behind them was their promise of differentiated performance: better risk-adjusted returns with a lower correlation to traditional capital markets. However, recent history suggests that the current generation of hedge funds lacks the edge of its predecessors. Do hedge funds still have an inherent […]

In Context: Credit Lines and Private Equity

I recently read a Bloomberg article titled, “Buyout Firms Are Magically — and Legally — Pumping Up Returns.” It is about vehicle-level leverage creeping into the private equity business. Here, I share some related thoughts for consideration. Early on, limited partners (LPs) allowed general partners (GPs) to arrange for small lines of credit (backstopped by […]

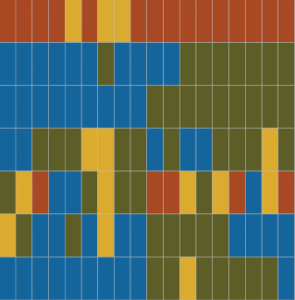

Creating Our Real Estate Indicators

Download Our Real Estate Indicators Our Real Estate Indicators, which attempt to provide insight about the commercial real estate market cycle, play a vital role in our conversations with clients and our approach to investing in this asset class. In this edition of our Real Assets Reporter, I describe the reason we developed the indicators, the process we […]

Private Real Estate Debt and Middle Market Direct Lending

Download PDF Private debt offers an attractive opportunity for some institutional investors in this challenging financial environment, as they confront low yields today yet need to bolster their portfolios against the impact of rising rates. At Callan’s 2017 National Conference, Kristin Bradbury of our Independent Adviser Group and Alex Browning of our Fund Sponsor Consulting […]

Private Equity Activity Trended Downward in 2016

Download PDF In the Winter edition of Private Markets Trends, I discuss the major themes of 2016 and the outlook for this year and beyond. Last year company investments and exits trended downward for both buyouts and venture capital, compared to 2015. But overall levels are high by historical standards (except for IPOs). And private […]

Alternative Facts and the Evolving Role of Hedge Funds

Download PDF Hedge funds have faced a difficult stretch, underperforming less-expensive alternatives for years. However, as lightly regulated managers with few investment constraints, hedge funds have a distinct advantage over traditional investments such as mutual funds. For this quarter’s Fiduciary Perspectives essay, “Alternative Facts and the Evolving Role of Hedge Funds,” I reflect on the current market environment affecting […]