A Tool to Stay on Top of Private Equity Fundraising

Because general partners only raise funds every three to four years, it is essential for institutional investors to stay ahead of private equity fundraising activity. Especially with the accelerated pace of fundraising in today’s market environment, it is easy to overlook a potential investment opportunity. To manage this process more effectively, Callan has developed what […]

Private Markets Stay Robust in 2017

View PDF As 2017 progressed, the private markets stayed on track to set records for fundraising. New private equity partnership commitments totaled $249.4 billion through the third quarter, up 29% from the same period in 2016, according to Private Equity Analyst, and on a pace to top the record $312 billion raised in 2016. And over three […]

Low Volatility + Rising Markets = Strong Liquidity

Low volatility and gently rising markets fostered ongoing “Golden Era” conditions in the private equity market. Fundraising is on pace to best last year’s post-GFC high; buyout and venture investments slowed slightly but dollar volume remained healthy.

Latest on the Private Markets

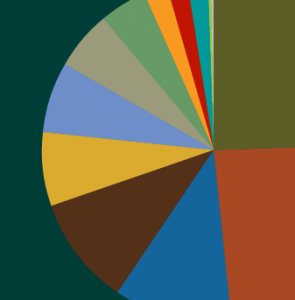

View PDF The private equity markets kept up their robust pace of fundraising in the second quarter. Buyouts continue to be the top strategy for limited partners, receiving more than 70% of commitments. Among the quarter’s other highlights: The share of money flowing to venture capital investments squeaked to double digits in the second quarter […]

Private Equity Survey (2017)

View PDF Callan conducted a survey of institutional private equity investors to offer insights relevant to the limited partner community. We focused on deployment models, patterns of investment and commitment activities over time, governance and oversight, staffing and resources, and responsibilities for program administration functions. Our Private Equity Survey included 69 institutional investors with $1.2 trillion of […]

Strong Start for Private Equity

View PDF The private equity market got off to a roaring start in the first quarter of 2017, with new commitments up sharply compared to last year. Here are some highlights from Callan’s Spring Private Markets Trends newsletter: Fundraising New private equity partnership commitments totaled $80.0 billion, with 310 new partnerships formed, according to Private […]

The Rewards of Private Equity’s ‘Unrewarded’ Risks

For many portfolios and asset allocation studies, private equity plays a starring role because it boasts high projected returns and low enough expected correlations that mathematical models such as mean variance optimization love it. But private equity is not magic. The reality is that valuation smoothing, company-size tilts, comparatively longer investment and holding periods, and […]

Private Equity on a Roll

View PDF New private equity partnership commitments totaled $80.0 billion in the first quarter, with 310 new partnerships formed, according to preliminary data from Private Equity Analyst. The number of partnerships jumped 75% from 177 in the first quarter of 2016, and the dollar volume rose 51% from $53.1 billion. KKR Americas Fund XII raised […]

In Context: Credit Lines and Private Equity

I recently read a Bloomberg article titled, “Buyout Firms Are Magically — and Legally — Pumping Up Returns.” It is about vehicle-level leverage creeping into the private equity business. Here, I share some related thoughts for consideration. Early on, limited partners (LPs) allowed general partners (GPs) to arrange for small lines of credit (backstopped by […]

Private Equity Activity Trended Downward in 2016

Download PDF In the Winter edition of Private Markets Trends, I discuss the major themes of 2016 and the outlook for this year and beyond. Last year company investments and exits trended downward for both buyouts and venture capital, compared to 2015. But overall levels are high by historical standards (except for IPOs). And private […]