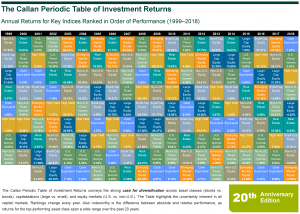

The Periodic Table Turns 20

Classic Table No one is more surprised than I am at the longevity and usefulness of the Callan Periodic Table of Investment Returns. I put the table together in 1999 as a lark, in an effort to convince our clients’ investment committees that U.S. large cap growth stocks were not always going to be the […]

Global Macroeconomic Environment: Is the Glass Half Full or Half Empty?

Investors’ appetite for risk, while elevated for much of 2018, evaporated as the year drew to a close and wiped out positive returns for the year across broad asset classes (T-bills being a notable exception). Concerns over tighter monetary policy and the global withdrawal of stimulus measures, unresolved trade disputes, falling oil prices, slower global […]

A Look at the Markets in 3Q18

U.S. stocks broadly rose, outpacing non-U.S. equities. Fixed income returns were muted, while real assets saw a wide range of results.

How Stocks, Bonds, and Real Assets Did in the 2nd Quarter

U.S. stocks did well in the 2nd quarter and outpaced non-U.S. equities. Rates rose in the U.S. and the yield curve flattened. Currencies drove returns for non-U.S. fixed income. Geopolitics played a big role in commodity returns

Under the Hood of the MSCI EM Index

Remember the BRIC countries? The acronym was coined in 2001 by Goldman Sachs economist Jim O’Neill for the economies of Brazil, Russia, India, and China to convey that their relative economic growth would continue to exceed that of the so-called Group of 7 (Britain, Canada, France, Germany, Italy, Japan, and the United States) and thus […]

Global Equities: Volatility Returns and Markets Sag

Volatility returned in the first quarter and U.S. equities faltered over concerns about a more aggressive global trade policy and uncertainty over the pace of interest rate hikes. .

Last Year, Not Last Week, Was Unusual

By Mark Andersen and Jay Kloepfer The S&P 500 entered correction territory last week, plunging more than 10 percent in five trading days after volatility exploded on Feb. 2. Investors betting on continuing low volatility saw big losses, and markets around the globe shuddered in response. As last week lurched along, with sharp reversals on […]

Equity Markets in Sync Around the World

View Market Review A strong quarter closed out a strong year for markets around the world, powered by synchronized global economic growth, a new tax law in the U.S., and low interest rates and inflation. Emerging markets outpaced developed markets for the fourth straight quarter. U.S. Stocks: Accelerating Growth Spurs Equities The U.S. equity market […]

Q&A: 2018 Capital Market Projections

View Projections View ‘Charticle’ Callan recently published our 2018 Capital Market Projections, detailing our expectations for return, volatility, and correlation for broad asset classes. These projections represent our best thinking regarding a longer-term outlook and are critical for strategic planning as our investor clients set investment expectations over five-year, ten-year, and longer time horizons. Over […]

Treasuries for the Long Run

View PDF In the current low-return environment, institutional investors have pursued high-return objectives by increasing their exposure to equity and equity-like investments. However, with uncertain profit growth, high equity valuations, and fresh memories of the Global Financial Crisis (GFC), they are also seeking investments to reduce equity risk. Since the timing and severity of any […]