Equities Off to a Strong Start; Inflation Fears Haunt Bonds

U.S. equities outpaced global stocks in 1Q21. The 10-year U.S. Treasury yield hit its highest intraday yield in 15 months during the quarter.

Equities Stage Big Rebound, While Bonds See Small Gains; Real Assets Mixed

Equity Markets U.S. stock indices continued to rebound from the 1Q plunge; the Russell 1000 was up more than 50% from the low reached on March 23. The S&P 500 Index was up 8.9% for the quarter, bringing its year-to-date result to 5.6%. However, returns among constituents painted starkly different pictures. Consumer Discretionary (+15%) was […]

Pandemic Fears Roil Equities Across the Board

U.S. stocks The S&P 500 Index plunged 19.6% in the first quarter, its worst quarterly return since the Global Financial Crisis. After falling more than 30% from peak to trough in just a few weeks, the Index rallied 20% going into quarter-end as investors were heartened by the prospect of a $2 trillion stimulus package. […]

Stocks and Bonds Lifted by Rate Cut Optimism

In the wake of the Fed’s announcement of a new policy objective—to “sustain the expansion”—U.S. Treasury and stock markets approached record highs in the second quarter, and the 10-year U.S. Treasury yield hit a multi-year low. Equity Markets The S&P 500 Index rose 4.3%, bringing its year-to-date return to 18.5%. Financials (+8.0%) were the best […]

Analyzing Russell’s 2019 Index Reconstitution

Index provider FTSE Russell recently completed the annual reconstitution of its Russell indices, which among other changes redefined the breakpoints between its large, mid, and small cap indices. These changes took effect at the close of trading on June 28. To better help institutional investors make sense of the process, I have highlighted some of […]

Excited About U.S. Equity Returns? Don’t Forget Pets.com

Over the past several years the performance of the U.S. equity market has widely outpaced the rest of the world. Part of the reason for that outperformance has been the superior growth trajectory in the U.S. following the Global Financial Crisis (GFC), and part stemmed from the expansion of multiples in U.S. equities. Another less […]

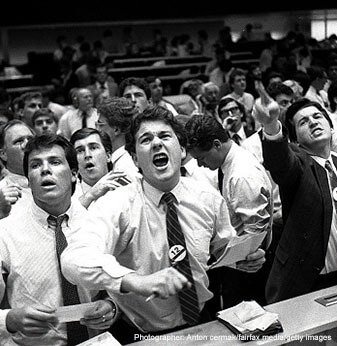

Rocky Ride for Equity Investors at the End of 2018

The fourth quarter saw volatility return with a vengeance, especially in December. While economic worries played a role, a government shutdown, continued trade rhetoric, and broad-based risk aversion also fueled the sell-off

Global Equities: Volatility Returns and Markets Sag

Volatility returned in the first quarter and U.S. equities faltered over concerns about a more aggressive global trade policy and uncertainty over the pace of interest rate hikes. .

Last Year, Not Last Week, Was Unusual

By Mark Andersen and Jay Kloepfer The S&P 500 entered correction territory last week, plunging more than 10 percent in five trading days after volatility exploded on Feb. 2. Investors betting on continuing low volatility saw big losses, and markets around the globe shuddered in response. As last week lurched along, with sharp reversals on […]

Equity Markets in Sync Around the World

View Market Review A strong quarter closed out a strong year for markets around the world, powered by synchronized global economic growth, a new tax law in the U.S., and low interest rates and inflation. Emerging markets outpaced developed markets for the fourth straight quarter. U.S. Stocks: Accelerating Growth Spurs Equities The U.S. equity market […]